ETH Price Prediction: Can Ethereum Sustain Its Rally Amid Bullish Momentum?

#ETH

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

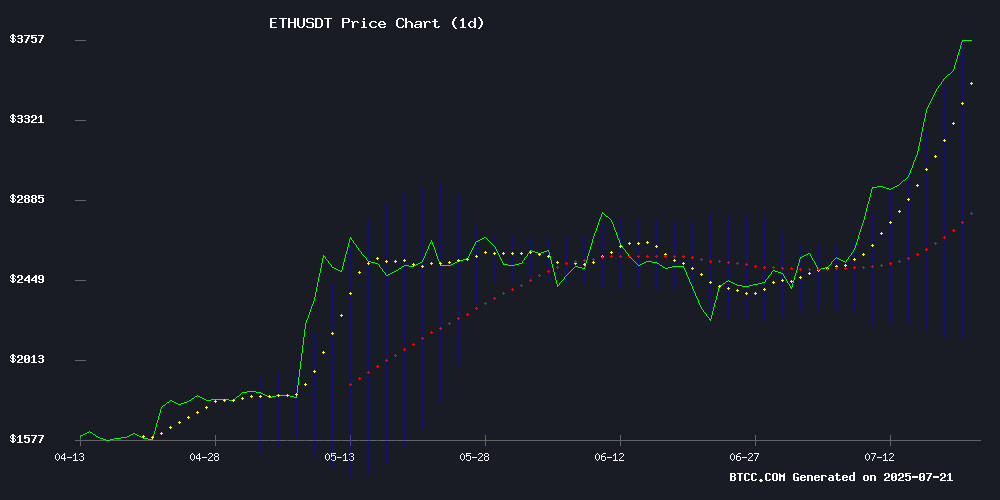

According to BTCC financial analyst Olivia, ethereum (ETH) is currently trading at 3779.08 USDT, significantly above its 20-day moving average (MA) of 3009.0825, indicating strong bullish momentum. The MACD (12,26,9) shows values of -525.9525 (MACD line), -356.8287 (signal line), and -169.1238 (histogram), suggesting a potential reversal as the histogram narrows. Bollinger Bands reveal the price near the upper band (3862.6287), with the middle band at 3009.0825 and the lower band at 2155.5363, signaling overbought conditions but with room for further upside if momentum sustains.

Ethereum Market Sentiment: Bullish Catalysts Dominate

BTCC financial analyst Olivia highlights a surge in positive sentiment for Ethereum, driven by headlines such as Pantera-backed Ether Machine's $1.5B ETH public listing, a $1B daily gain in the NFT market, and Ethereum's Fusaka hard fork nearing completion. Whale activity, including the acquisition of 45 CryptoPunks, and political interest from figures like Donald TRUMP further fuel optimism. However, Olivia cautions about potential short-term pullbacks due to overheated futures markets, though validator support for gas limit increases to 45 million could bolster network throughput and long-term growth.

Factors Influencing ETH’s Price

Pantera-Backed Ether Machine to Go Public With $1.5 Billion in ETH

Ethereum's institutional appeal grows as The Ether Machine, a newly formed entity, prepares to go public with $1.5 billion in committed capital—primarily held in 400,000 ETH. The venture aims to provide institutional-grade exposure to ethereum and ETH-denominated yield.

Backed by $800 million from investors like Pantera Capital, Electric Capital, and Kraken, the firm positions itself as an "ether generation company" rather than a treasury vehicle. Andrew Keys, Co-Founder and Chairman, contributed $645 million to the initial capital, calling ETH "the digital oil powering the next era of the digital economy."

The Ether Machine's launch marks one of the largest pools of ETH assets in a public investment vehicle, targeting market-leading yields through active management by its self-described "Ethereum Avengers" team.

NFT Market Surges with $1 Billion Daily Gain as Blue-Chip Collections Lead Rally

The NFT market capitalization surged 23% to $6.3 billion in a single day, with trading volume spiking 287% to $37.4 million, signaling a potential revival in the sector. Blue-chip collections like CryptoPunks and Pudgy Penguins spearheaded the rally, posting double-digit gains in floor prices and sales volume.

CryptoPunks saw its floor price jump 16% to 47.5 ETH ($179,000), accompanied by $14 million in sales. Pudgy Penguins climbed 15% to 16.6 ETH, with $5.7 million in trading activity. The broader market followed suit, with Infinex Patrons and Bored APE Yacht Club registering 9%+ gains.

Memeland's exclusive YOU THE REAL MVP collection emerged as an outlier, skyrocketing 1,280% to 69 ETH. The resurgence appears driven by renewed institutional interest and cultural momentum, particularly around Ethereum-based assets.

Whale Acquires 45 CryptoPunks Amid Ethereum Rally, Boosting NFT Market

A significant whale transaction has reignited interest in CryptoPunks, the iconic NFT collection, as Ethereum's price rally fuels broader digital asset enthusiasm. The anonymous buyer spent 2,082 ETH ($5.87 million) to acquire 45 Punks through OpenSea, driving the collection's floor price up 20% to 47.50 ETH.

On-chain data reveals the purchasing wallet was newly created on July 18, funded by an exchange address with no prior NFT activity. This single transaction accounted for nearly 60% of the 76 CryptoPunks traded recently, signaling renewed demand without apparent external catalysts beyond ETH's momentum.

The movement marks CryptoPunks' most notable activity since Yuga Labs' intellectual property acquisition, suggesting NFTs may be poised for recovery as crypto markets awaken. Market observers note the collection's resurgence lacks the speculative airdrop incentives that drove previous NFT frenzies, potentially indicating more organic interest.

Ethereum's Fusaka Hard Fork Nears Completion Amid Network Upgrades

Ethereum's Fusaka hard fork is on track for a November rollout, featuring EIP-7825 to bolster network security against malicious attacks. A proposed gas limit increase to 150M aims to enhance throughput, though proposals like EIP-7907 were scrapped to expedite testing.

The upgrade builds on the Pectra hard fork's advancements, including account abstraction and improved layer-2 efficiency—critical steps in Ethereum's competition with rival blockchains for DeFi dominance. Developer Nixo highlighted tight deadlines ahead of November's Devconnect event, urging client releases within ~1.5 months.

Following Fusaka, the Glamsterdam upgrade—now in final development—will further refine Ethereum's infrastructure. These iterative improvements underscore Ethereum's commitment to scalability and security as DeFi demand grows.

Ethereum Celebrates 10-Year Anniversary with NFT Torch and Market Dominance

Ethereum marks its 10-year anniversary with a symbolic NFT torch initiative, embodying its decentralized ethos. The digital relay, launched on July 21st, began with co-founder Joseph Lubin and will traverse wallets of key community members before concluding on July 30th. A commemorative NFT will be available for public minting, cementing the milestone.

Amid the celebrations, Ethereum continues to lead the NFT market, boasting $75 million in trading volume. ETH's price and market cap have surged, reflecting sustained investor confidence. The network's decade-long journey from a cryptocurrency to a decentralized internet foundation remains a testament to its enduring influence.

Trump Bets Big on Ethereum (ETH)—Is He Seeing the Future

Ethereum (ETH) is emerging as a dominant force in the cryptocurrency market, currently trading at $3,779 with a 3% gain. The token's steady accumulation of momentum suggests a potential for significant upward movement, despite periods of stagnation.

U.S. President Donald Trump's cryptocurrency portfolio has drawn attention, with Ethereum comprising 93% of his holdings. This heavy allocation raises questions about Trump's insights into ETH's future role in the U.S. financial landscape. Market speculation is fueling bullish sentiment, as traders interpret Trump's accumulation as a signal of institutional confidence.

The convergence of Ethereum's technical strength and high-profile political endorsement creates a compelling narrative for the asset's growth trajectory. Market participants are now closely watching whether ETH can capitalize on this momentum to reach new price targets.

Ethereum Faces Potential Pullback Amid Overheated Futures Market

Ethereum's recent rally to just above $4,000 has been fueled by strong spot ETF inflows and corporate buying, but the market shows signs of exhaustion. The Relative Strength Index (RSI) is overheated, and 95% of ETH supply is in profit—a classic signal for potential profit-taking. Derivatives now dominate daily trading volumes, raising concerns this surge could be a leverage-driven bubble.

Weekly charts highlight two critical resistance levels at $2,850 and $3,750, the latter acting as a liquidity pocket that may trigger short-term reversal. Despite seven consecutive days of gains totaling 27.4%, the surging futures basis and lack of proportional spot activity heighten risks of a sharp correction. Large holders continue accumulating, but retail traders should tread carefully.

Ethereum Validators Rally Behind Gas Limit Increase to 45 Million, Boosting Network Throughput

Ethereum's transaction processing capacity is climbing as validators signal strong support for raising the network's gas limit to 45 million units. The weekend saw the gas limit rise 3% to 37.3 million, with some blocks proposing even higher thresholds—marking the first significant increase since February's jump from 30 million to 36 million.

Throughput on Ethereum's base LAYER has correspondingly improved, with transactions per second approaching 18 over the weekend according to Chainspect data. This continues an upward trend from February's 15 TPS baseline. The scaling push gains legitimacy as nearly half of staked ETH now backs the grassroots 'pump the gas' campaign, with Vitalik Buterin noting 47.2% validator approval for the 45 million target.

Higher gas limits enable more transactions per block, reducing fees and improving network efficiency. Validators can autonomously adjust limits by 0.1% per block when consensus emerges—a feature now being tested as Ethereum's ecosystem prepares for its next growth phase.

NFT Market Cap Surges 21% to $6.3B as Ethereum Collections Spark Revival

The NFT market erupted with activity on Monday, witnessing a 21% surge in total market capitalization—climbing from $5.1 billion to $6.3 billion overnight. The rally was fueled by renewed interest in Ethereum-based collections, ending months of stagnation.

A high-profile CryptoPunk buying spree served as the primary catalyst. On-chain data reveals a newly created wallet, 0x1bb3, spent 2,082 ETH ($5.87 million) to acquire 45 CryptoPunk NFTs within hours. The wallet now holds assets valued at over 1,700 ETH ($6.5 million) on OpenSea.

CryptoPunks dominated the rally, with floor prices jumping 14% to $175,320. The project topped 24-hour sales volume at $14.7 million—an 11,143% daily increase. Other Ethereum collections followed suit: Moonbirds ROSE 31.1%, Pudgy Penguins gained 2.7%, and Bored Ape Yacht Club climbed 6.9%. Niche projects like Infynex Patron advanced 9.4%.

The broad-based uptick signals shifting sentiment as capital rotates back into blue-chip NFTs. Market participants are interpreting the whale activity as a bullish signal for Ethereum's digital collectibles ecosystem.

NFT Market Cap Surges $1 Billion in a Day Amid Signs of Revival

The NFT market is showing early signs of resurgence, with its total capitalization jumping from $5.1 billion to $6.3 billion within 24 hours—a 20% gain. Trading volume skyrocketed 287% to $37.4 million, according to CoinGecko data. This marks the most significant single-day growth since the sector's 2022 downturn.

CryptoPunks led the charge with a 16% floor price increase to 47.5 ETH ($179,000), generating $14 million in daily sales. Pudgy Penguins followed closely, rising 15% to 16.6 ETH with $5.7 million in volume. Ethereum-based collections like Bored Ape Yacht Club and Infinex Patrons saw 9%+ gains, while the obscure YOU THE REAL MVP group exploded 1,280% to 69 ETH.

The movement suggests renewed speculative interest, though whether this represents sustainable demand or short-term froth remains unclear. Market participants are speculating about potential NFT treasury vehicles as a catalyst.

Ethereum NFT Torch Ignites for 10-Year Celebration

Ethereum is marking its upcoming tenth anniversary with the launch of a symbolic NFT torch. Designed to embody the foundational values of the Ethereum ecosystem, the initiative highlights the network's enduring influence in the blockchain space.

The celebration underscores Ethereum's evolution from a smart contract platform to a cultural and technological force, particularly in the NFT sector. Market participants are watching for potential momentum shifts as the anniversary approaches.

How High Will ETH Price Go?

Olivia projects ETH could test resistance near the Bollinger Upper Band (3862.63 USDT) in the short term, with a breakout potentially targeting 4200 USDT. Key drivers include:

| Factor | Impact |

|---|---|

| Technical Momentum | Price above 20-day MA, MACD convergence |

| NFT Market Revival | $1B daily cap surge, blue-chip demand |

| Network Upgrades | Fusaka hard fork, gas limit increase |

| Macro Sentiment | Institutional interest (Pantera, Trump) |

Risks include futures market overheating and profit-taking near ATHs.

- Technical Strength: ETH trades above key MAs with narrowing MACD bearish divergence.

- Ecosystem Growth: NFT market cap surges 21% to $6.3B, driven by Ethereum collections.

- Network Upgrades: Fusaka hard fork and validator-led throughput improvements boost fundamentals.